Let’s be honest. When you’re planning a life of remote work in Bali or a corporate stint in Berlin, health insurance is probably the last thing on your mind. It’s paperwork. It’s confusing. It feels about as exciting as watching paint dry.

But here’s the deal: it’s your single most important safety net. A broken ankle in Thailand or a sudden illness in Chile isn’t just a hiccup—it can be a financial catastrophe without the right plan. So, let’s dive into what you actually need to consider. No fluff, just the real talk.

Why Your Home Country Plan Probably Won’t Cut It

First things first. That solid plan you have back home? It likely has a giant, invisible fence around your country’s borders. Most domestic health insurance policies offer little to no coverage once you’re living abroad long-term. Some might cover short tourist trips, but the moment you become a resident or stay for months, you’re on your own.

Think of it like a cell phone plan with no roaming. Works great locally, but try to use it internationally and you’ll get a nasty surprise bill. You need a plan built for global coverage.

Key Considerations for Your Global Health Cover

1. Geography: Where Can You Actually Use It?

This is the big one. Insurers typically break down coverage into regions:

- Worldwide (excluding USA/Canada): The most common and cost-effective for most nomads. The US and Canada have notoriously high medical costs, so excluding them keeps premiums lower.

- Worldwide (including USA/Canada): Essential if you plan to spend significant time in North America. It’s pricier, but frankly, it’s non-negotiable if you’re going there.

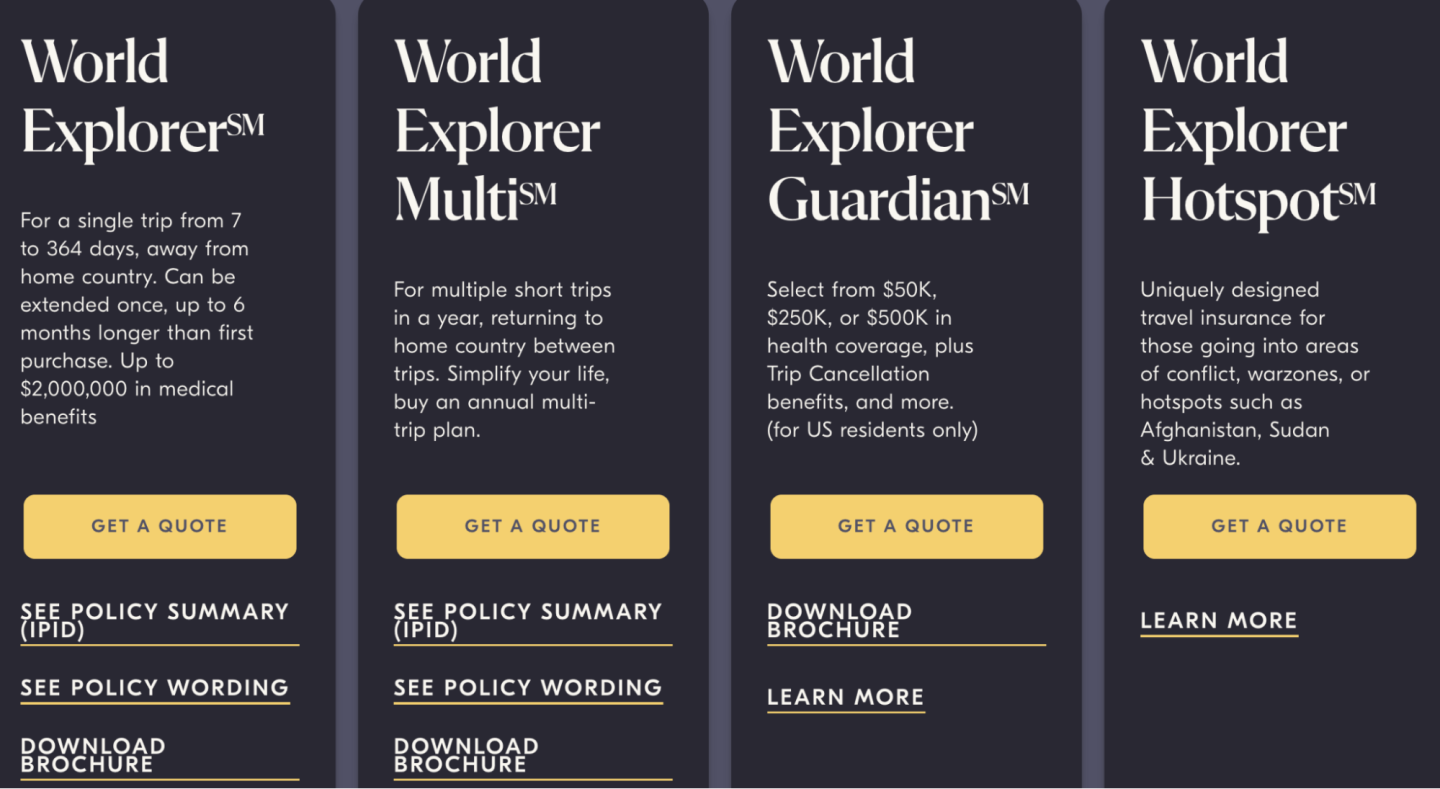

- Regional plans: Maybe you’re only bouncing around Southeast Asia or Europe. Some insurers offer regional-specific plans that can be a great fit.

2. The Core Coverage You Can’t Ignore

Look, a plan is more than just a premium. You have to peek under the hood. Here’s what to scrutinize:

- Inpatient & Hospitalization: This is the big-ticket coverage. It should be robust—think millions in coverage, not thousands.

- Outpatient Care: Doctor visits, specialist consultations. Surprisingly, some cheaper plans skimp here.

- Medical Evacuation & Repatriation: This is your “get out of jail free” card. If you have a serious accident in a remote location, they’ll fly you to a proper hospital. Or, in the worst case, repatriate remains. Morbid, but vital.

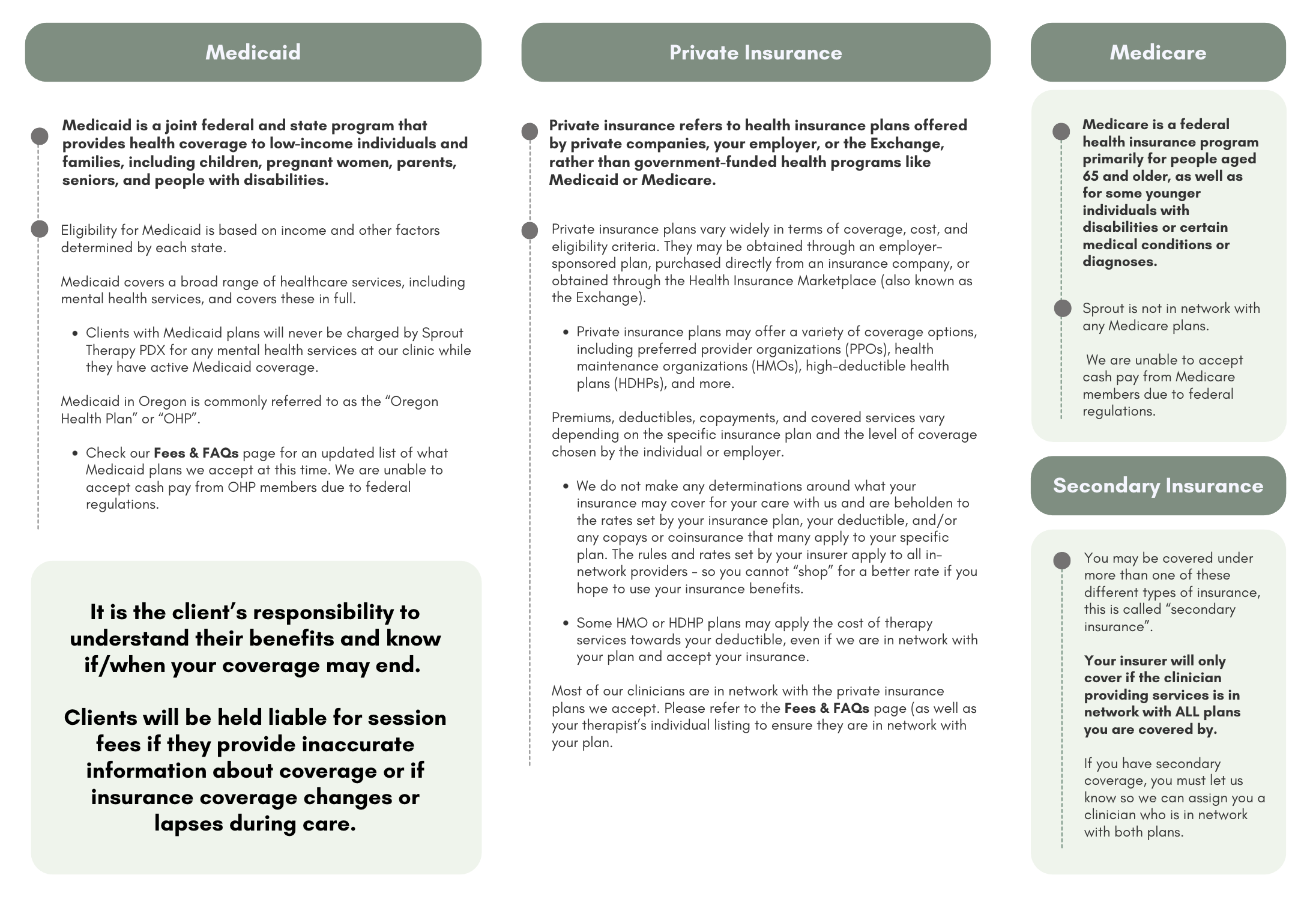

- Pre-existing Conditions: The thorniest issue. Many plans exclude them entirely, some impose waiting periods, and a few might cover them with a higher premium. Full transparency is key.

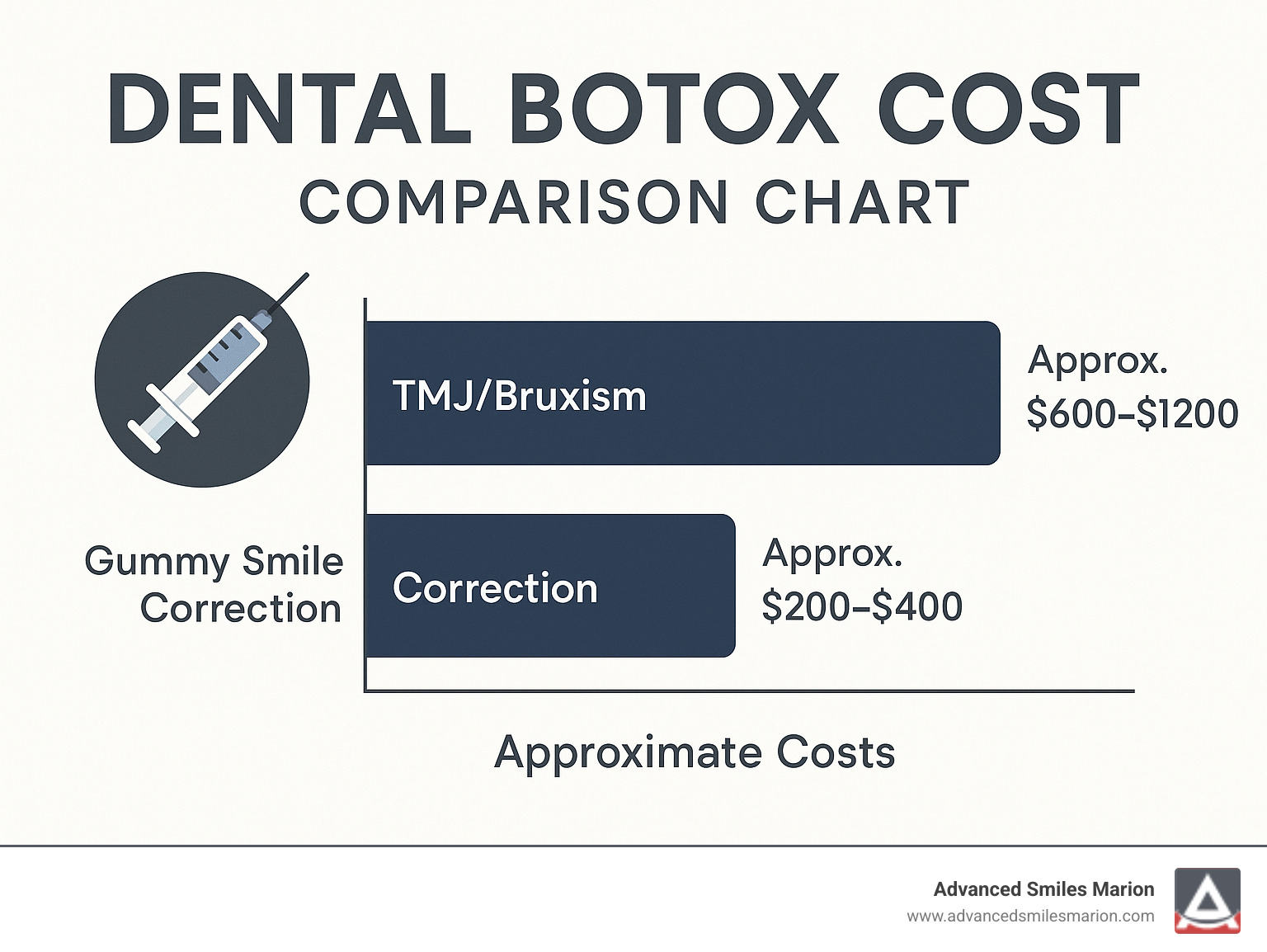

- Dental & Vision: Often add-ons. Decide if you want them bundled or will pay out-of-pocket.

3. The Financials: Deductibles, Co-pays, and Premiums

It’s a balancing act. A deductible is the amount you pay before insurance kicks in. Choosing a higher deductible lowers your monthly premium, but means you pay more upfront if something happens. A co-pay is a fixed amount you pay for a service (like $30 per doctor visit).

You need to play with these numbers. If you’re young, healthy, and on a budget, a higher deductible might make sense. If you want predictability, a lower deductible with a slightly higher premium could be better.

Digital Nomad vs. Traditional Expat: Is There a Difference?

Well, yes and no. Their insurance needs often overlap, but the devil’s in the details.

| Consideration | Digital Nomad (Often location-independent) | Traditional Expat (Often on a local contract) |

| Primary Need | Flexibility, global portability, no “home base” requirement. | Compliance with local visa/law, integration into a specific country’s system. |

| Common Solution | International private medical insurance (IPMI) or dedicated nomad plans. | IPMI or sometimes mandatory local national health insurance. |

| Duration | Can be shorter-term, more fluid. | Typically longer-term, aligned with a 2-3 year assignment. |

| Pain Point | Finding a plan that doesn’t require permanent residency anywhere. | Navigating between employer-provided cover and local mandates. |

Honestly, the line is blurring. Many traditional insurers now offer flexible products that suit both crowds. The key is to be clear about your own lifestyle pattern.

Practical Steps to Getting Insured

Feeling overwhelmed? Don’t be. Break it down.

- Audit your lifestyle. List the countries you’ll live in, for how long, and any known health issues. Be realistic.

- Get multiple quotes. Use a broker who specializes in expat insurance. They know the market and can explain the fine print. Seriously, this saves headaches.

- Read the policy wording. Yes, the dense document. Focus on exclusions, claim procedures, and network hospitals. Is it a cashless system, or do you pay and claim back?

- Consider the add-ons. Adventure sports coverage if you’re a scuba diver? Pregnancy cover if you’re planning a family? Think ahead.

- Check the renewal terms. Can the insurer jack up your premium massively as you age? Are they known for canceling policies?

A Final, Uncomfortable Truth

Insurance is a bet. You’re betting something will go wrong. The insurer is betting it won’t. For the digital nomad or expat, the stakes of that bet are just… higher. The safety nets of home—family, familiar systems, government healthcare—are gone.

Choosing a plan isn’t about finding the absolute cheapest option. It’s about buying peace of mind. It’s the knowledge that if you wake up with a severe pain in a foreign city, your first thought can be “I need a doctor,” not “How will I pay for this?” That freedom, that security, is what you’re really investing in. It’s the foundation that lets the adventure truly thrive.